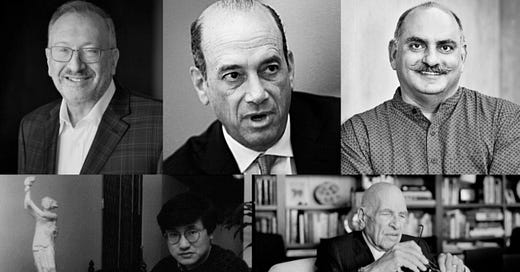

Lessons From 5 Value Investors That Outperformed The Market

Summary: Only a handful of investors have outperformed the market over decades. Here I present the principles of 5 highly successful value investors you might’ve not heard about, who have consistently outperformed the market. These investors might not be as well known as Warren Buffett or Benjamin Graham, but have doubtlessly inherited their wisdom. I will present the 10x principles for investing and market outperformance that have guided our strategy at 10x Value Partners. The insights can teach us valuable lessons that transcend the financial realm: : (i) play the long-game, (ii) invest in what you understand, (iii) focus on intrinsic value, (iv) be contrarian, and (v) learn voraciously. Leveraging these in your personal and professional life can help you maximize your wealth and pick the best opportunities for growth.

Introduction

Outperforming the market consistently over the long term is a goal shared by many investors. However, few investment strategies have been as successful in achieving this feat as value investing.

Value investing, an approach rooted in the identification and fundamental analysis of undervalued assets, seeks to exploit the gap between a security's market price and its intrinsic worth. By capitalizing on this difference, known as the margin of safety, value investors have achieved superior returns and outperform the market.

The heart of value investing lies in seeking out securities whose intrinsic worth surpasses their current market price, providing a margin of safety for investors. By focusing on the fundamental value of assets rather than short-term market fluctuations, value investors align their decisions with the true underlying potential of businesses.

Value investing isn’t just one of many methods to make money. It is the only reliable investment technique to make money in the long term.

The strategy encourages a long-term perspective, which requires patience and discipline, virtues which contrast the appeal of quick profits often associated with day trading or gambling.

Moreover, value investing extends beyond monetary gains. By adopting the value investor’s principles to assess opportunities, practitioners can apply these skills to various aspects of life, leading to the discovery of invaluable opportunities beyond just managing finances. The emphasis on risk management, patience, and a comprehensive understanding can help individuals make informed decisions that can positively impact their personal and professional pursuits. If you want to read more on how to improve the quality of your decisions, check out my article.

In this article, I will explore the lessons from the most prominent value investors who have outperformed the market over the past century, some of which are popular while others are less well known. I will then present The 10x Principles Of Investing that guide our strategy at 10x Value Partners. Finally, I will show What Value Investing Can Teach Us About Life, insights which will help you grow in your personal and professional life.

1. Seth Klarman

Results

The Baupost Group Global Value Fund has averaged an annual return of 20% for 30 years, or 15% since its inception in 1983, so for 40 years.

This compares to an annual return of 10.3% for the S&P 500 over the same period.

Background

Seth Klarman is the author of ‘Margin of Safety: Risk-Averse Value Investing Strategies for The Thoughtful Investor’, a popular book in the value investing world, which is read ‘almost daily’ by Warren Buffett. Klarman’s investment successes have earned him the title of ‘the Oracle of Boston’.

Limited copies of the book were published, which increased the price of the book from its initial $25 price tag to more than $1,000.

Klarman has amassed a personal net worth of $1.5 billion by buying undervalued stocks and keeping them for the long term. He started investing when he was only 25.

His fund, The Baupost Group Global Value Fund, has $30 billion in assets under management.

Principles

(i) Secure a Margin of Safety

“A margin of safety is achieved when stocks are purchased at prices sufficiently below the underlying value in order to allow for some human error” - Seth Klarman

A margin of safety is the difference between the market price of a security and your estimation of its intrinsic value when the market price is significantly below that value estimation.

Klarman recognizes that investing always involves a risk, and the way to ensure your investments yield returns is to reduce downside risk, i.e., limit the possibility of losing money as much as possible. To do so, it is crucial to make investments only in assets you deem to be below their intrinsic value. This way, you have a safety cushion to protect you from human error or unexpected events.

“...valuation is an imprecise art, the future is unpredictable, and investors are human and do make mistakes.” - Seth Klarman

For example, if you estimate the intrinsic value of a stock to be around $300 and you purchase at $290, your margin of safety will be quite small (there will be little room for error in your valuation). If instead you purchase at $240, you’ll have left plenty of room for error, ensuring the stock is indeed undervalued and a more secure investment.

(ii) Avoid losses

“Loss avoidance must be the cornerstone of your investment philosophy.” - Seth Klarman

For Klarman, you should design a portfolio that is not exposed to losses of principal capital over five to ten years. This doesn’t mean investors should stick to bonds or avoid risks at all, but you should prioritize avoiding losses over maximizing gains.

Rather than focusing on ‘the next hot stock’, focusing on avoiding losses is actually the best way to ensure positive returns.

(iii) Ignore price fluctuations

“...investors should expect prices to fluctuate and should not invest in securities they cannot tolerate some volatility.” - Seth Klarman

Klarman warns against taking short-term fluctuations too seriously, whether it’s price increase or price decrease. These are completely unrelated to the value of the investment, which can only be truly manifested in the long-run.

Conventional wisdom would have a reduction in price as the sign of a higher risk, but Klarman explains risk has little to do with that. Instead, risk is all about assessing the fundamentals. If they’re strong, the risk is low, whatever the momentary fluctuations in price.

It’s still wise to avoid buying overpriced stocks, but ultimately, short-term market volatility should not play a significant role in your investment decisions.

(iv) Be an investor, not a speculator

“Every stock is a part of a business, and by buying a stock, you are buying a piece of a business.” - Seth Klarman

What does he mean by this?

By seeing the stock as part of a business, you don’t attempt to predict its price by studying other random external factors. Instead, you know your investment returns will be directly correlated to (and caused by) the growth of the business.

Instead of making a decision on whether a stock is going up or down, like speculators tend to do, Klarman only looks at fundamentals. Speculating is a losing game. The only way to secure returns is being a value investor. Klarman insists investors ditch formulas and focus only on fundamental analysis. There are no shortcuts.

“The financial markets are far too complex to be incorporated into a formula” - Seth Klarman

(v) Be contrarian

“Being a value investor usually means standing apart from the crowd, challenging conventional wisdom, and opposing the prevailing investment winds.” - Seth Klarman

In 2012, Baupost Group purchased more than $450 million of creditors' claims to Lehman Brothers after the company went bankrupt in 2008. A year later, those claims traded more than 100% higher and would turn into huge returns for the funds that purchased them.

Taking a contrarian view is part of Klarman’s fundamental philosophy. Where others see failure and losses, Klarman sees a huge possibility for gains.

Recently, Klarman spoke about commercial real estate to CNBC. "We think real estate is an area that is full of so many fundamental challenges, but the fundamental challenges have caused urgent selling… You can see a pullback in lending, you can see vacancies in office, troubles in retail for years and years. And so that doesn't automatically make it interesting. But it may mean that as other people abandon it ... there may be opportunities to buy." This shows the contrarian nature of his thinking.

To do so, cultivating patience is key. He explains value investing is the “disciplined pursuit of bargains”. This makes value investing difficult, but ultimately worth it. Keeping a long-term view is essential, as in the short-term, value investors might look like they’re experiencing poor results.

Going against standing opinion requires unique insight, courage and consistency.

These principles make up Seth Klarman’s investment philosophy, and are invaluable lessons for all value investors.

2. Li Lu

Results

Li Lu has reportedly produced a 30% compound annual return since its inception in 1998, so for more than 20 years.

This compares to an annual return of 11.1% for the S&P 500 over the same period.

Background

Li Lu is a prominent Chinese-American investor and founder of Himalaya Capital, an investment partnership known for its focus on a select few high-quality businesses. Lu's unique value investing philosophy has been influenced by his early life experiences during China's Cultural Revolution, his subsequent political activism during the Tiananmen Square protests, and his formal education at Columbia University, where he was deeply influenced by the teachings of Benjamin Graham and Warren Buffett.

Warren Buffett himself once said, "If I were to pick one person to manage my money if I die, it would be Li Lu."

Li Lu’s investment returns were so good during college, after he had a talk with Warren Buffett and implemented his approach, that he actually made enough money to retire.

A $1000 investment with Himalaya Capital and Mr. Li Lu would have a total return of $321,000 compared to $6600 achieved by the S&P 500 over the same time period. So it shouldn’t come as a surprise that Charlie Munger himself has entrusted his own money to Li Lu. But how exactly did Li Lu achieve such amazing returns?

Principles

(i) Understand yourself and your investment

“The game of investing is a process of discovering who you are, what you're interested in, what you're good at, what you love to do, then magnifying that until you gain a sizable edge over all the other people.” - Li Lu

Li Lu stresses the importance of personal understanding and deep knowledge of one's strengths and weaknesses. Investors should focus on their areas of expertise or their circle of competence and refrain from investing in businesses they do not thoroughly understand. It is in your unique set of skills that you’ll find your investing advantage. However, understanding what one does not know is just as important.

“Investing is about predicting the future, and the future is inherently unpredictable. Therefore, the only way you can do better is to assess all the facts and truly know what you know and know what you don't know. That's your probability edge.” - Li Lu

A value investor needs to be comfortable being in the minority. This is because you will have to adopt a position not because others agree with you, but because of your fundamental analysis guided by reason and evidence.

Li Lu believes that every investor should be able to predict the most likely outcomes for the next 10 years of his companies, and also predict the next 2 years with a 90% degree of certainty.

(ii) Favor small and concentrated portfolios

Only by focusing on a specific niche that you understand will you deepen your knowledge and recognize great opportunities as they present to you.

Li Lu believes in the power of small-cap stocks and concentrated portfolios. Small-cap companies can outperform larger ones due to lack of coverage, and concentrating investments can ensure that only the best ideas get funded. This requires deep, intensive research and analysis.

A case in point is Lu's investment in Timberland. Despite the company being out of market favor and facing multiple lawsuits, Lu recognized its potential, as it was trading at 'clean' book value and had been steadily reducing its debt. He invested 20% of his portfolio in Timberland and witnessed a significant return when the stock rose by 700% within two years, showing the effectiveness of a concentrated investment in a well-understood, small-cap company.

"Being an investor is a lot like being a research journalist. You have to dig into the company on a level that journalists do when they research their stories before investing." - Li Lu

(iii) Be contrarian

“In my view, the biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices, not risk, but it is an opportunity. Where else do you look for cheap stocks?” - Li Lu

Li Lu sees times of crisis as an opportunity, rather than responding with concern or fear.

His investment in Russian oil stocks in the 1990s illustrates this contrarian approach. Amidst the chaotic transformation of the Russian economy following the collapse of the USSR, Li identified a significant discrepancy between the market value of newly privatized Russian oil companies and their underlying assets. Despite the market's doubts and the lack of a mature stock exchange, he invested in Lukoil (LUKOY). He recognized that these firms, despite being deeply discounted, maintained their monopolistic positions in the oil and gas sectors. This investment saw a tenfold increase by 1998, even weathering the Asian Financial Crisis with significant profits.

The ability to think differently, long-term, and with a contrarian outlook is a cornerstone of Li Lu's investment philosophy. It involves scanning for parts of the market where investors are selling for reasons other than a fundamental assessment of value, thereby presenting profitable opportunities.

(iv) Secure a margin of safety

“If you are wrong you won't lose a lot but if you are right you're going to make a lot.” - Li Lu

For Li Lu the price paid for a security is an important factor in maintaining a margin of safety. He insists that investors should purchase securities at prices significantly below their underlying value, providing a buffer for human error or unexpected market volatility.

Li Lu holds a strong opinion that the market is irrational and will provide value investors with plenty of opportunities so long as they are willing to put in the work and dig into the research.

“If the quality of the asset you are buying is very high, your demand on an asset basis will be low. You have to have an insight as to what those assets could generate for you to determine your demand.” - Li Lu

(v) Be patient yet decisive

Patience and decisiveness are virtues of a successful investor. Li Lu takes Warren Buffett's advice of being fearful when others are greedy and greedy when others are fearful. He believes that a good investor should not panic at falling prices but should view them as an opportunity.

"Only when you have deep knowledge of an asset can you watch your portfolio go down by 50% without being emotionally affected." - Li Lu

When he launched his fund, Himalaya Capital, he experienced a loss of -19% in his first year. For many, this could have been a devastating blow that could lead to doubt and second-guessing of their investment strategy. However, Li Lu was not swayed from his core principles and remained decisive.

"If you don’t have any insights or understanding of the business, when it goes from $100 to $50 you aren’t going to know whether it will go back to $100 or down to $0." - Li Lu

(vi) Use ROIC

Like Charlie Munger, Li Lu emphasizes the importance of using and considering ROIC to value stocks.

ROIC is the Return On Investment Capital, a metric that measures “a company’s efficiency in allocating capital to profitable investments” (Investopedia).

For Li Lu, it’s not just a measure of a company’s returns, it’s also the best way for a business to achieve a competitive advantage and obtain superior performance over its peers over the long term. Sure, it produces more money for investors, but most importantly, a high return on capital strengthens the business as well.

He believes that it is an important metric because “the longer you are holding a stock, the more your return will be similar to the ROIC of the business”.

3. Walter Schloss

Results

Walter J. Schloss and Associates investment partnership achieved an average annual return of 21% over the 47 years Schloss managed it.

This compares to an annual return of 10.3% for the S&P 500 over the same period.

Background

Walter Schloss was one of the "Superinvestors" Warren Buffett mentioned in his famous 1984 essay, "The Superinvestors of Graham-and-Doddsville." Schloss never had any formal education beyond high school, yet he managed to establish an extraordinary investment record by applying the principles of value investing he learned while working as a security analyst for Benjamin Graham in the early 1940s. His investment successes are evinced by the fact a $10,000 investment turned into $52,000,000.

Walter Schloss’s investment approach was straightforward – he focused on buying cheap stocks. That is, he invested in companies that were selling at prices below their net asset value. Schloss kept things simple. He didn’t meet with management, didn’t look at macroeconomic conditions, and didn’t use a computer. He focused solely on a company’s balance sheet to determine whether it was a good investment.

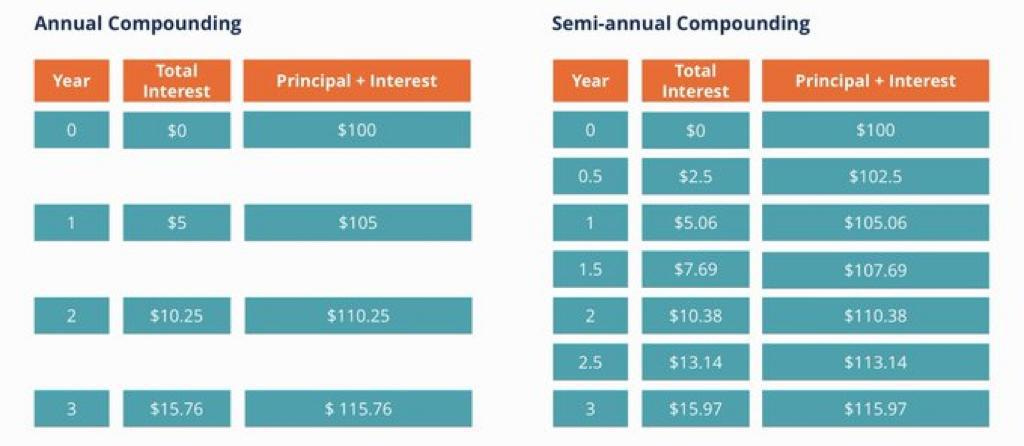

Principles

(i) Correctness of judgment

"You can't make good decisions without good judgment, and you can't have good judgment without experience." - Walter Schloss

Schloss believed Investing success is heavily reliant on the accuracy and consistency of your judgment. More often than not, individuals fail to review and test their decisions with the rigor necessary for sustained investing success.

It is crucial that investors maintain an open, curious mind and constantly seek out new information. How an investor responds to new information concerning their investments can significantly impact the accuracy of their judgment. An effective investor should have the flexibility to reassess their investments as new information emerges and adjust their strategies accordingly.

A strong investment speaks for itself, it stands on its own merit based on its fundamental value. You shouldn’t need to convince yourself of an investment. It should be convincing because of factual evidence.

(ii) Never sell on bad news

How an investor responds to negative news can significantly impact their investment performance. It is often said that "fear and greed" drive the stock market, and this is particularly evident during periods of negative news when many investors succumb to panic selling.

More often than not, selling on bad news results in losses as stocks tend to recover shortly after an initial panic-induced drop.

This is not to say that one should hold onto a stock indefinitely regardless of the circumstances. If the fundamental thesis for owning the stock changes - for instance, due to a significant shift in the company's business model or competitive landscape - then selling may indeed be the appropriate action.

However, a knee-jerk reaction to sell on bad news without carefully considering the long-term implications can prove detrimental to your investing success. This principle highlights the importance of taking a measured, thoughtful approach to investing, and the necessity of keeping emotions in check during times of market turmoil.

Statistically, stocks recover shortly after.

(iii) No talking to management

The question of whether to engage with a company's management is a topic of debate among investors. While some find it essential to understand the management's perspectives, plans, and behaviors, Walter Schloss avoided these interactions.

Many swear on talking to management to get an idea of how they think and behave. But Schloss believed that basing an investment decision on an assessment of management could introduce personal bias and cloud his judgment.

"We're not good at judging management. We try to buy stock cheap. We're not trying to buy wonderful companies that are cheap. We're just trying to buy cheap stocks." - Walter Schloss

Schloss maintained a detached, numbers-driven approach, focusing more on whether the company's stocks were trading at a discount to their intrinsic value rather than on qualitative factors like the reputation of its management. He didn't trust his ability to judge character and consequently avoided management meetings.

(iv) Focus on numbers

Walter Schloss didn’t talk to management and simply invested in very cheap stocks, so he focused on numbers. He placed a heavy emphasis on numerical analysis, especially on book value, when assessing potential investments.

“Asset values fluctuate more slowly than earnings do.” - Walter Schloss

Schloss preferred to invest in stocks trading significantly below their book value, often at just ½ or ⅔ of this value. For him, this quantitative measure was a more reliable and less volatile indicator of a company's worth than earnings, which can fluctuate more significantly and unpredictably.

The focus on numerical analysis and book value allowed Schloss to cut through market noise and sentiment, concentrating instead on the intrinsic worth of a business. This approach served him well, proving the power of a steadfast focus on the fundamentals.

"Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper." - Walter Schloss

(v) Diversification

Schloss didn’t dig too deep into his investments. Instead, he favored diversification to spread risk across numerous investments.

He bought lots of very cheap stocks, holding between 60 to 100 positions in his portfolio at any given time.

Schloss knew not all of them would be winners, but the low price was his margin of safety. He saw diversification as a buffer, a safety margin against the inherent unpredictability of the market. This approach allowed him to cushion the impact of any underperformers on his portfolio's overall performance.

"We like to buy a lot of stocks cheaply... You don't know ahead of time which ones are going to develop quickly and which will develop slowly, and which ones are not going to work out. But that's what diversification is all about." - Walter Schloss

For Schloss, the 'winners' in his portfolio were the real drivers of his performance. The broad diversification allowed him to offset losses from any individual investment while capitalizing on the significant returns from his winning picks.

(vi) Averaging in

Walter Schloss firmly believed in active participation to fully understand an investment. He advocated establishing multiple small positions initially, instead of diving in with a significant investment right away.

"Buying cheap stocks doesn’t guarantee success, but if you buy enough of them, you’ll most likely achieve good results." - Walter Schloss

Over time, as he observed these positions and gained a deeper understanding of their performance, he would average into these positions, gradually building them up. This allowed him to mitigate potential losses and gain familiarity with his investments while remaining actively engaged.

"It's a question of feeling your way along. As it gets better, you let it go up. As it doesn't improve, you can sell out. So you work your way along with the stock." - Walter Schloss

(vii) The math of investing

Throughout Schloss’ investment career, he benefited from two simple principles that characterized his strategy:

1 - Losses weigh more than gains.

Losing 30% on an investment requires more than a 30% gain to return to the initial investment value. For instance, if you have $100 and lose 30%, you are left with $70. To get back to $100, you need a return of approximately 43% on the $70..

Solution: Focus on the Downside.

The asymmetry underscores the importance of focusing on the downside, preventing losses, and securing a margin of safety

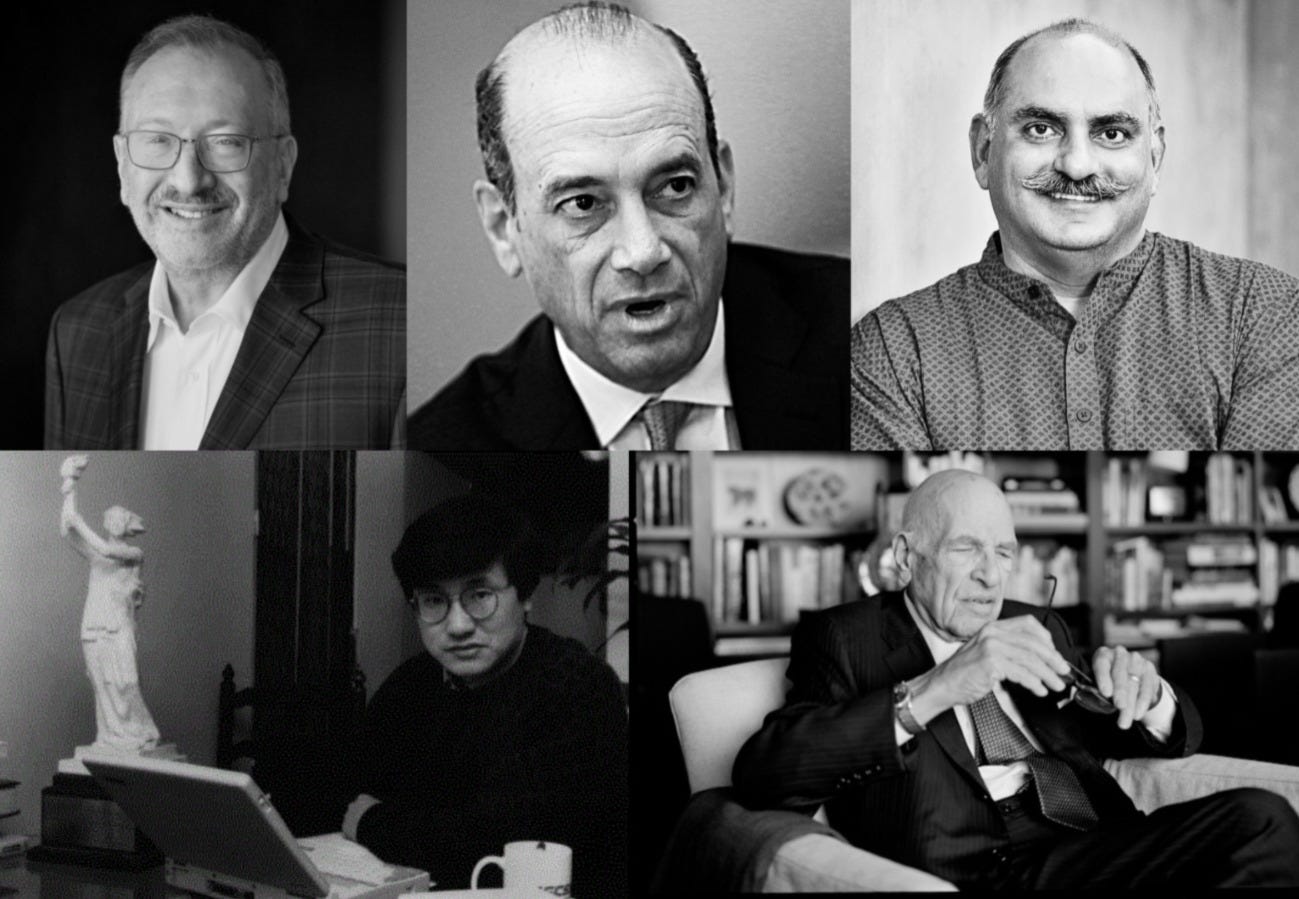

2 - Compound interest frequency

By consistently identifying, buying, and selling undervalued companies, Schloss was able to compound his investments at a faster rate than if he held on to great companies over a long period.

Although this approach necessitates more work in finding many undervalued companies, the rewards of higher frequency compounding can be very profitable.

This strategy echoes the early approach of Warren Buffett, who initially built his wealth by investing in "cigar butts" or companies trading well below their intrinsic value.

A longer version of these principles were published in 1994 by Walter & Edwin Schloss Associates, L. P. You can view the full list below.

4. Joel Greenblatt

Results

Gotham Capital, under the management of Joel Greenblatt, achieved an average annual return of 53.3% over 10 years (from 1985-1995).

This compares to an annual return of 15.6% for the S&P 500 over the same period.

Background

Greenblatt's journey started in academia as a finance professor at Columbia University School of Business, the same institution where Warren Buffett honed his skills under Benjamin Graham, the father of value investing. In 1985, he transitioned from teaching to practicing his theories by starting Gotham Capital.

Greenblatt's investment philosophy is based on the idea of finding undervalued companies and holding them for the long term. He developed a formula called the Magic Formula, which he uses to identify undervalued companies. The Magic Formula looks for companies that have high earnings yields and low price-to-book ratios.

Greenblatt is a respected figure in the investment world, and his investment philosophy has been successful in generating significant returns for investors. His book The Little Book that Beats the Market is a popular introduction to value investing, and it has helped to introduce the Magic Formula to a wider audience.

Principles

The principles are articulated in his book, The Little Book that Beats the Market, and adapted from Thomas Herold’s article.

(i) Embrace simplicity

For Greenblatt, the hard part of investing is to focus on the “easy” companies.

His primary investment principle revolves around a fundamental understanding of a business before committing any capital. It is not the complexity of the investment idea that matters, but the returns it can generate over time.

"I think the hard part is limiting yourself to those companies that you can figure out the normalized earnings for. I only limit myself to those companies I can figure out the normalized earnings." - Joel Greenblatt

This shows Greenblatt’s emphasis on understanding the business model and its profit-generating potential in the long run.

(ii) Focus on normalized earnings

Greenblatt places considerable emphasis on the concept of "normalized earnings". These are the earnings that a business would generate over a typical economic cycle, discounting the impact of short-term disturbances. His approach reflects his belief that Wall Street often gets preoccupied with minor details and loses sight of the broader, more significant picture.

In the context of investing in tech companies, this idea can be adapted by looking at long-term earning potential. Tech companies often go through phases of rapid growth and expansion, where they might incur high costs or have low earnings as they invest in research and development, user acquisition, and market penetration. These factors can lead to short-term financial results that may not reflect the company's true value or future earning potential.

In such cases, investors can focus on "normalized earnings" by assessing the company's long-term earning potentials. This could involve analyzing the scalability of the tech company's business model, its market share and growth potential, the sustainability of its competitive advantages, and its future profit margins once it has matured and its growth has stabilized.

At 10x Value Partners we invest in tech startups, and looking at normalized long-term profitability is a cornerstone of our investment philosophy (see below).

“The thinking on AXP is this: usually when I buy a stock, it goes down. Number two is this: if I am truly taking a three or four year horizon in my valuation, then what’s happening in the short term doesn’t matter. What matters is what I think normalized earnings will be three years from now.” - Joel Greenblatt

Even the best businesses can face short-term challenges for a few quarters, the point is this should not be pivotal in investment decisions. If a high-quality business faces challenges that are not fatal, don’t let that get to you and keep in mind what’s really important.

(iii) Understand incentives

Greenblatt believes in the importance of understanding the incentives of a company's management team. He believes that individuals' motivations could significantly impact the decisions they make for the company, thereby influencing its performance.

By analyzing these incentives, investors can gain insights into potential future actions, providing valuable predictive insights.

“[When evaluating management] I am just trying to evaluate how certain people will act in their own best interests. How are these guys incentivized? What was the incentive to do this particular thing? If people are not incentivized to do a good job, they generally won’t do it. […] You must expect people will act in their best interests and know how they are incentivized

Do they keep stealing as much as they can and keep blowing it out? If they are buying back stock over the past few years, it’s probably cheap or they wouldn’t do that.” - Joel Greenblatt

(iv) Ignore short-term price fluctuations

Greenblatt has a core belief in the market's rationality over the long term, despite its erratic behavior in the short term. He perceives the discrepancy between a company's short-term market valuation and its intrinsic business value as an investment opportunity.

"Why does the price of a stock fluctuate so much when compared to its real value? The answer to this question is: I don’t know and I don’t care… I just want to take advantage of it… I can guarantee that if you do good valuation work and you end up being right, Mr. Market will pay you back in time.” - Joel Greenblatt

He understands that market inefficiencies exist, but over time, the market corrects itself and reflects a company's true worth. So, it’s key to keep a long-term perspective.

(v) Control emotions and do proper valuation

Finally, Greenblatt advocates the importance of doing diligent valuation work and mastering emotional control in the investment process. He stresses that success in investing is not about chasing fluctuating prices but about accurately evaluating companies and patiently waiting for the right price to invest.

"The problem with beating the market is that people can’t control their emotions and they don’t do the proper valuation work." - Joel Greenbaltt

Greenblatt thinks investors must do two simple things:

Value Companies

Wait for the right price

5. Mohnish Pabrai

Results

Pabrai Investment Funds has averaged an annual return of over 25% since its inception in 1999, so for nearly 25 years.

This compares to an annual return of 9.7% for the S&P 500 over the same period.

Background

Mohnish Pabrai is an Indian-American businessman, investor, and philanthropist. He is the founder and managing partner of the Pabrai Investment Funds, a family of funds inspired by the original 1950s Buffett Partnerships. Pabrai has been a student of value investing and the teachings of Warren Buffett and Charlie Munger. His investment strategy emphasizes low risk, high-uncertainty businesses purchased at attractive prices.

One of his most notable investment successes was with the auto parts retailer, AutoZone. In 1999, he invested $650,000 in the company, a value that ballooned to $25 million by 2007, significantly contributing to the growth of his investment fund.

In "The Dhandho Investor: The Low-Risk Value Method to High Returns", Pabrai provides a detailed overview of his investment philosophy. It outlines several key lessons.

Principles

(i) ‘Heads I win, tails I don’t lose much’

“The key to being a successful investor is to buy assets consistently below what they are worth and to fixate on absolutely minimizing permanent realized losses.” - Mohnish Pabrai

In The Dhandho Investor, Pabrai lays the foundation for his investment philosophy with the principle 'Heads I win, tails I don’t lose much.' This concept signifies the importance of asymmetrical risk-reward in investing - the potential upside should far outweigh the downside.

The essence here is to scout for opportunities where the potential return is high, and the risk of substantial permanent loss is minimal. Pabrai advises buying assets well below their intrinsic value, which creates a margin of safety and minimizes the risk of permanent loss.

"Dhandho," which translates to "endeavors that create wealth," is an overarching principle in Pabrai's investing philosophy. The Dhandho framework entails investing in businesses with durable competitive advantages, or 'moats.' By focusing on businesses with a sustainable moat, Pabrai seeks to ensure that the wealth generated by these companies is not fleeting but will endure over the long term.

A cornerstone of Pabrai's strategy is identifying 'offering gaps,' opportunities where market imperfections or mispricing exist. His approach revolves around the idea that patient investors can realize substantial gains by capitalizing on the market's short-term mispricings of these robust businesses.

(ii) Few bets, big bets, and infrequent bets

Instead of spreading investments across many securities, they should identify a handful of high-quality, undervalued businesses.

This approach also stresses patience over action. Rather than continually buying and selling, Pabrai advises investors to wait. The goal is to wait for the perfect opportunity to invest significantly in these chosen businesses.

Central to this philosophy is the idea of betting heavily when the odds are extremely favorable. These opportunities, while rare, can offer high returns. Pabrai encourages investors to be patient for these moments, then invest heavily when they arise.

"Looking out for mispriced betting opportunities and betting heavily when the odds are overwhelmingly in your favor is the ticket to wealth. If you can find situations where you have a 90% chance of winning and you are willing to risk 10% of your portfolio on each bet, you will eventually become very wealthy." - Mohnish Pabrai

The Kelly Formula provides guidance on determining the size of these bets. It's a simple equation: Edge/Odds equals the fraction of your funds to bet each time. If an investor can calculate a business's intrinsic value over the next few years, and can acquire a stake at a price significantly lower, profit is almost certain.

Pabrai acknowledges that predicting odds can be error-prone. After all, these predictions rely on personal understanding and worldview. To mitigate this, he suggests using conservative odds.

(iii) Invest during pessimistic times

Mohnish Pabrai emphasizes the importance of market sentiment. He identifies two market states: euphoria and pessimism. It’s easier to find mispriced securities during pessimistic periods. This is because fear tends to cloud investors' judgment, leading to undervalued opportunities.

“The markets vacillate between fear and greed… Generally when you have multi-decade periods of that sort of activity then market participants throw in the towel and go on. That’s when you should be stepping in as an investor.” - Mohnish Pabrai

This also shows Pabrai’s belief in the power of contrarian investing, stepping in when others are fearful, thereby capitalizing on market pessimism.

(iv) Invest in copycats rather than innovators

Pabrai suggests investments on copycats rather than innovators are a safe, and powerful bet.

The flagship product that allowed Microsoft to scale exponentially wasn’t developed in-house. It was lifted from Seattle Computer. They have looked for customer validation of someone else’s innovation before embarking on their own. It is a very powerful strategy.

Pabrai argues that in many instances, businesses that clone proven models face lower risk and often achieve high returns. He explains good cloners are great businesses.

“Innovation is a crapshoot, but investing in businesses that are simply good copycats and adopting innovations created elsewhere rules the world.” - Mohnish Pabrai

Good investment ideas are rare, valuable and subject to competitive appropriation just as good product or business acquisition ideas are.

(v) Patience is the most important quality

“Good traits, or important traits for being a good investor, number one the single most important skill is patience.” - Mohnish Pabrai

Pabrai puts patience at the top of the checklist for qualities value investors should have. From the lessons seen from others, it is easy to see why this key personality trait is crucial in the value investing process.

“…the thing is that markets have kind of a way of deceiving us, because you know when you turn on CNBC and you see all those flashing red and green lights and all that, it's inducing the brain to think that you need to act now, and you need to act immediately. Nothing could be further from the truth.” - Mohnish Pabrai

Pabrai endorses Warren Buffett's punch card analogy that suggests investors should only make 20 major investment decisions in their lifetime. This implies an average of one investment every three years if one starts investing at 20 and ends at 80, a concept challenging for many. He insists on slowing down investing activities and concentrating more on the fundamental changes in businesses, rather than focusing on stock market trends. According to Pabrai, a deep understanding of businesses and commitment to long-term investing yield success.

(vi) Invest in simple businesses

“The best investments are the ones that are the biggest no brainers.” - Mohnish Pabrai

The intrinsic value of any business is determined by the cash inflows and outflows – discounted at an appropriate interest rate – that can be expected to occur during the remaining life of the business. If it’s valuable, invest, if it isn’t, don’t; there’s no secret recipe.

What is a simple business? One where conservative assumptions about future cash flows are easy to figure out.

Pabrai recalls Einstein noted that the five ascending levels of intellect were, “Smart, Intelligent, Brilliant, Genius, Simple.” He endorses this principle and aims to invest in painfully simple businesses.

“The most important thing is that, before you invest, you should be able to explain the thesis without a spreadsheet within four or five sentences. Typically I write down those sentences before I invest, so if I have a conversation with someone you could very quickly explain why this investment makes sense.” —Mohnish Pabrai

(vii) Low risk, high uncertainty

The market often confuses risk and uncertainty, leading to mispriced businesses. He suggests targeting investments in businesses facing high uncertainty but low risk of permanent capital loss, which are often distressed businesses in struggling industries. These are usually ignored by investors and can be bought at a discount.

Pabrai points out that human psychology significantly impacts the buying and selling of stocks, often more than the transactions of entire businesses. Therefore, the trick is to recognize the theater where there's a mass exodus due to perceived fire, but you know the fire is either nonexistent or well on its way to being extinguished. This knowledge allows you to invest in seats in these theaters at low prices.

Finally, Pabrai emphasizes the importance of high dividend yields as potential indicators of undervalued stocks. He also warns against investing in rapidly changing industries, suggesting they pose a significant risk to investors. Instead, he advises narrowing down to businesses that are well-understood and currently in a distressed state.

(viii) Look for exceptional managers

“The only evolution, not so much in the Dhandho framework but more in my own framework of looking at businesses, is that I pay more attention to the qualitative factors around a business than the quantitative.” – Mohnish Pabrai

Over time, Pabrai has seen an evolution in his investment framework. He admits to paying more attention to the qualitative factors surrounding a business than the quantitative aspects. This approach complements his investment style, which revolves around understanding the business, identifying its intrinsic value, and assessing the quality of its management before making an investment decision.

Particularly, Pabrai seeks out exceptional managers. No matter how strong a business model is, without efficient management, it will fall apart. But the question is how to ascertain if the management is efficient enough.

Parbai says that apart from checking the management's historical performance, investors should also check if the management is inherently frugal.

These are the key principles in Pabrai’s philosophy. The Dhandho Framework, which Pabrai presents in his book, can be seen below.

The 10x Principles For Value Investing

Having presented the insights of value investors who’ve beat the market over decades, I will now present the principles that have informed our value investing strategy, which has allowed us to achieve market outperformance over the years. At 10x Value Partners, we adhere to four key principles. These principles guide our investment decisions, helping us find opportunities that deliver meaningful returns while keeping risk in check. Here's a brief look at each principle:

(i) Contrarian thinking

One of the pillars of 10x Value Partners’ and Utopia Capital’s philosophy is our advocacy of contrarian thinking. This characterizes not only our investment strategy but also how we work on all fronts at the company.

Being contrarian isn’t just about opposing the mainstream for the sake of it. It’s about cultivating independent thinking and rigorous analysis to find truths that nobody else is able to spot.

For example, while many people feed into the idea that the world has unsolvable problems that will only get worse with time, for example, climate change, we have developed 8 Utopia goals to fight the biggest challenges that humanity is currently facing. We don’t only think that climate change can be stopped. We believe that climate change can be reversed by 2063 and are actively investing in companies that can bring about the change.

(ii) Avoiding losses / downside protection

One of our guiding principles is ensuring downside protection. This principle, also shared by most value investors, is about limiting exposure to potential financial losses.

Even though investing in startups, the focus of 10x Value Partners, inherently involves high risk, our rigorous and in-depth analysis of a business's potential success affords us a margin of safety. The above value investors obtain a margin of safety by investing in undervalued companies. Instead, it’s our diligent focus on understanding companies and investing in those which our analysis clearly shows are poised for success that provides the margin.

Avoiding losses involves being slightly conservative. We're not particularly drawn to the latest industry trends or investment hype. Instead, we focus on investments that demonstrate potential for consistent performance and long-term profitability. We believe that our understanding of a business's value and its market potential helps us limit downside risk and maximizes the likelihood of a positive return on our investments.

(iii) Look at the business model

At 10x Value Partners, we prioritize understanding the business model over evaluating the management team. While leadership is crucial, we believe a robust, scalable, and sustainable business model is the cornerstone of long-term profitability.

Our focus is on normalized long-term profitability. We seek businesses that have built an efficient model to generate consistent revenues over the long run, have a clear path to profitability, and are positioned well in a growing market. We evaluate the unit economics, market size, competitive landscape, pricing power, and customer acquisition and retention strategies to make our investment decisions.

Take Henry, for example. When we decided to invest in this pioneering tech education platform, it was not only the innovative idea that attracted us but its business model. Henry offers an Income Share Agreement model, where students pay for their education only after they secure a job. This model solves a significant pain point for students unable to afford quality tech education upfront, creating a wide market opportunity.

Moreover, Henry’s model is designed to align their success with their students’, providing a robust incentive to offer high-quality education and job placement services. This built-in incentive increases the chances of sustained, long-term profitability – a prime example of the type of business model we look for in our investments.

(iv) Asymmetric risk / return ratio

The term "asymmetric risk/return ratio" refers to an investment approach that aims to maximize potential gains while minimizing possible losses. In other words, the potential for gain significantly outweighs the potential for loss.

This relation between risk and return is true for most start-up investing, our focus at 10x Value Partners. Startups, particularly in their early stages, present a high-risk, high-reward scenario. While the risk of loss is substantial (about 95% of startups fail), successful ones can provide returns that significantly exceed the initial investment, often by multiples. This disproportionate risk/reward balance characterizes the asymmetry.

At 10x, we ensure our evaluation of a company’s potential is comprehensive, and we are confident in our ability to spot the successful 5%. Startups have a huge risk of failure. What ensures the asymmetry we seek for is that we have the right combination of expertise.

The Value Investing Matrix

Having seen the principles of 5 value investors, plus our own investment philosophy, we can summarize each to facilitate comparison between each.

What Value Investing Can Teach Us About Life

Value investing has led these successful investors to amassing great wealth. The principles that guide these investors, however, extend far beyond the realm of finance.

They provide a robust framework that can significantly improve decision-making, inspire personal and professional growth, and enhance life management.

A bit like what they say about investmenting, these principles invite us to view life as a portfolio where opportunities are investment options, decisions are our investments, and the outcomes, our returns. These are the core rules to learn from these amazing leaders.

(i) Play the long game

Value investing is not about instant gratification. It's a long-term game that requires patience to wait for the right investment opportunity and then the patience to let it mature.

Markets fluctuate, but value investors stay patient and stick to their strategy. Applying a long-term perspective to investing allows one to ride out market fluctuations and focus on the enduring potential of assets.

In life, the "long game" approach is about making decisions that will create lasting positive impacts. It cultivates patience, discipline, and strategic thinking - qualities that significantly contribute to personal and professional growth.

(ii) Invest in what you understand

Value investing at its core is about limiting downside risk. If things go well, you get a huge deal of value. If things don’t go well, you don’t lose too much. This key insight can be used to guide your decision making more generally, regardless of whether it’s in or outside the financial context.

The best way to ensure you limit risk is by knowing exactly what you are getting yourself into by studying and understanding it. In investing, this usually consists in doing a fundamental analysis of the business.

In real life, this boils down to embracing the opportunities that you understand, and which you can properly evaluate the potential for failure/harm. It can be getting to really know a person before moving in with them, or understanding the culture of a company that just offered you a job before taking it.

The old saying ‘step into the unknown’, is not a wise one according to the principles of value investing. It’s of course key to take risks and really put yourself out there, but picking opportunities you don’t really understand, and which you can properly evaluate the risk involved, isn’t brave or bright, but the opposite.

(iii) Look for intrinsic value / limit downside risk

The fundamental premise of value investing is buying assets that are undervalued based on their intrinsic value. One should seek assets that, through exhaustively studying them, have perceivable value over the long term, despite what everyone else might be thinking about its current value. This presence of intrinsic value which others haven’t yet spotted or aren’t spotting is the key to limiting downside risk.

In life, this can mean seeking opportunities or relationships that hold genuine, often overlooked, value rather than those that simply appear attractive on the surface.

Crucially, value is not usually hidden behind layers of analysis, but pretty evident as soon as you scratch just below the surface. Don’t overcomplicate things, if an opportunity is good, then you’ll know once you really see it.

The upshot of only opting for the truly valuable paths is limiting the possibility of failure or loss. When you patiently wait for intrinsically valuable opportunities, you will limit what can go wrong.

“You only have to do a very few things right in your life so long as you don’t do too many things wrong.” - Warren Buffett

Watch the downside of your decisions carefully. Make sure that if the worst-case scenario happens, you survive to play another round.

(iv) Be contrarian

In a world that often rewards conformity, contrarian thinking can help you grow into your own, critical, self. This can lead to innovative ideas and solutions.

Professionally, it can make you a more creative problem solver, a forward thinker, and a leader. Personally, it can lead to greater self-confidence, as you learn to trust your judgment and make decisions aligned with your values, even when they defy conventional wisdom.

(v) Learn voraciously

Rather than a principle shared by all value investors, learning voraciously is a quality they all have in common. They recognize the power of knowledge and embrace continuous learning.

Insatiable curiosity is crucial to achieve the results outlined, but also to excel in anything you set yourself to in life, as it allows you to become adaptable, innovative, open minded, and full of life.

Pabrai emphasizes the power of knowledge in investing, implying that all knowledge is cumulative. Even if a previous investment research didn't lead to an immediate investment, the understanding gained from that research could be useful in future investments. A part of this knowledge accumulation involves reading voraciously and waiting patiently for the right investment opportunities. This echoes the idea of compound knowledge, of which I’ve written in another article.

…

I hope that the lessons from some of the most successful value investors I have reviewed in this article can help you in your future endeavors, be that in your personal or professional life. Thank you for taking the time to read.