Revenue to EBITDA Waterfall: CM1 & CM2 As Key Metrics To Uncover Unit Economics and Understand Economies of Scale

Summary: Think about the path from Revenue to EBITDA as a waterfall. This path represents the various stages a company’s revenue goes through and its per unit profitability — from initial sales, through deducting production costs (COGS), service delivery costs, marketing expenses, and finally, fixed overheads—until you arrive at EBITDA, a key profitability metric. At each point of this waterfall, you can 'zoom in' to understand the specific costs and margins at play, such as Gross Margin, Contribution Margin 1 (CM1), and Contribution Margin 2 (CM2). This granularity provides crucial insights that traditional metrics like Gross Margin and SG&A alone often miss. By focusing on CM1 and CM2, businesses can uncover hidden costs, better steer their operations, spot profit leaks, and make smarter decisions, positioning themselves for sustainable growth and improved profitability.

1. Introduction: Understanding the Revenue to EBITDA Waterfall

The Revenue to EBITDA Waterfall is a breakdown of the journey from top-line revenue to bottom-line EBITDA (earnings before interest, taxes, depreciation, and amortization).

This breakdown offers a nuanced view of a company's financial health, revealing how revenue flows through various cost structures to reach profitability.

While traditional accounting metrics, such as those found in a Profit and Loss (P&L) statement, offer valuable insights into a company's overall performance, they often lack the granularity needed to analyze specific cost components like customer acquisition or service delivery.

Specifically, the traditional grouping of costs into SG&A (Selling, General, and Administrative) expenses can obscure the distinction between variable costs that scale with revenue and fixed costs that do not. SG&A bundles a wide range of expenses together, making it hard to see where economies of scale are being achieved.

Source: WallStreetPrep

To address this gap, the Revenue to EBITDA Waterfall can be enhanced by reallocating certain costs from SG&A and linking them more directly to Gross Margin, allowing for a clearer understanding of how variable these costs are. This creates a more gradual scale between fully variable costs, like COGS (Cost of Goods Sold), and the more fixed overheads that are less likely to change with increased sales volume (barely variable).

This approach highlights the degree to which a business is achieving economies of scale.

When a company is achieving economies of scale, it means that as the company grows and increases its production output, its cost per unit decreases. This happens because certain costs—such as administrative overhead, infrastructure, or fixed costs like machinery—remain constant or increase at a slower rate than the company's output, allowing the business to spread these costs over more units of production.

Understanding fully variable and barely variable costs is crucial because it helps identify where economies of scale are being realized and where cost-saving opportunities lie as production scales up.

To dig deeper, businesses can use financial indicators like Contribution Margin 1 (CM1) and Contribution Margin 2 (CM2), which separate key costs such as service delivery and marketing, respectively. By doing so, businesses can gain a clearer view of their cost structure, identify areas of inefficiency, and make more informed decisions about scaling operations.

For example, companies like Rocket Internet have effectively used this waterfall approach to optimize profitability and achieve scalability by tracking these metrics closely.

By the end of this article, you will better understand how to break down the Revenue to EBITDA Waterfall, use CM1 and CM2 to reallocate costs, and uncover the hidden economies of scale that are critical for driving scalable profitability.

2. Breaking Down the Waterfall: From Revenue to EBITDA

The Revenue to EBITDA waterfall provides a clear roadmap for understanding how money flows through your business, starting from the top line (revenue) and trickling down through various cost layers to determine your profitability. By breaking this process down step-by-step, you can identify the key points where money is either earned or lost and make smarter decisions to maximize profits.

At the top of the waterfall is your total revenue, which is the income generated from your core business activities, such as sales of products or services. Revenue is crucial because it represents the starting point of your business’s financial picture. However, it's only one part of the equation—without properly understanding the costs that come next, revenue alone won’t tell you whether your business is truly profitable or scalable.

Cost of Goods Sold (COGS) includes the direct costs of producing your goods or services, such as materials, labor, and production overhead. Understanding COGS is critical because it directly affects your gross margin.

Lowering COGS without sacrificing product quality is one way to increase profitability, but doing so requires a granular understanding of what goes into production costs.

2.1. Gross Margin: The First Key Metric

Gross Margin is the first major indicator of profitability in the waterfall. It’s calculated by subtracting COGS from your revenue:

Gross Margin = Revenue - COGS

This metric tells you how much of your revenue is left after covering the direct costs of production. It helps you assess whether your core business activities are profitable.

For example, if your gross margin is high, it indicates that your product or service is priced well enough to cover the costs of production with a healthy profit buffer.

However, gross margin isn’t enough to understand true profitability or scale potential. This is because gross margin only accounts for direct production costs and doesn’t consider other crucial expenses like service delivery or marketing, which can significantly affect your bottom line. To get a fuller picture, you need to go beyond gross margin and dive deeper into metrics like Contribution Margin 1 (CM1) and Contribution Margin 2 (CM2).

By breaking down these additional costs, businesses can gain more granular insights into their operations, allowing them to uncover hidden inefficiencies and improve decision-making.

2.2. Contribution Margin 1 (CM1): A More Granular Insight

Contribution Margin 1 (CM1) takes the analysis a step further by subtracting the direct costs of service delivery from your gross margin. CM1 helps businesses understand their unit economics in greater detail by focusing not only on production costs but also on the expenses associated with delivering the product or service to the customer.

CM1 = Gross Margin - Cost of Service Delivery

Costs of service delivery may include payment processing fees, hosting costs, customer service, shipping, and other expenses directly tied to getting the product or service into the hands of the customer. These are critical costs that are often overlooked when focusing solely on gross margin.

CM1 is critical. It is a more accurate indicator of unit economics because it drills down into the true costs of maintaining a business beyond the initial production phase.

For instance, many D2C (Direct-to-Consumer) companies struggle to achieve profitability despite high gross margins because their service delivery costs eat into their profits. CM1 helps identify these hidden costs and offers insights into which areas of service delivery could be optimized to improve overall profitability.

Here’s an example.

Imagine a subscription-based eCommerce company that sells curated boxes of premium skincare products. While the gross margin may appear healthy after accounting for the cost of the products themselves, CM1 could reveal significant costs related to payment processing fees, shipping, and customer support, which dramatically reduce profitability.

Understanding these additional costs through CM1 helps the business make better decisions about pricing, delivery methods, and customer service policies, ultimately leading to improved margins.

In essence, CM1 provides a more detailed and actionable insight into the true performance of your business, enabling you to spot inefficiencies that gross margin alone wouldn’t reveal.

2.3. Contribution Margin 2 (CM2): Adding Marketing Costs

Contribution Margin 2 (CM2) goes even deeper into understanding profitability by taking into account marketing costs. After calculating CM1, CM2 subtracts marketing expenses, which are often significant in businesses, especially those that rely on digital or performance marketing to acquire customers.

CM2 = CM1 - Marketing Costs

Marketing costs can include anything from paid advertising campaigns, influencer partnerships, email marketing efforts, to promotional discounts aimed at acquiring new customers. These expenses are often essential for driving revenue, but they can also erode profitability if not managed carefully.

Marketing is a double-edged sword for most businesses.

On the one hand, it's crucial for customer acquisition and driving sales. On the other hand, it can be a drain on profitability if the cost of acquiring a customer outweighs the lifetime value that customer brings. CM2 helps businesses assess whether their marketing efforts are cost-effective and sustainable in the long term.

By examining CM2, businesses can start to see a clearer picture of their true profitability once marketing efforts are factored in.

This metric forces companies to ask critical questions:

Is our customer acquisition cost too high?

Are our marketing campaigns leading to long-term customer loyalty or just short-term gains?

Take an eCommerce fashion brand that spends heavily on Instagram ads to drive traffic to its website. CM1 might indicate that the business is profitable on a per-unit basis after subtracting production and service delivery costs. However, once marketing costs are factored in, CM2 might reveal that the brand is spending far too much on customer acquisition, resulting in thin or even negative profit margins.

In this case, reducing marketing spend or finding more cost-effective customer acquisition channels could significantly improve CM2, boosting the brand’s profitability and revealing its true scaling potential.

CM2 allows businesses to identify when they’ve reached the point where scaling becomes possible.

By reducing marketing costs or improving the efficiency of marketing efforts, companies can increase their CM2 and lay the foundation for sustainable growth. If marketing costs are slashed while CM1 remains healthy, this signals that the business is ready to scale profitably, as customer acquisition becomes less of a burden on overall profitability.

By calculating and analyzing CM2, businesses can uncover a more realistic view of their financial health, making smarter decisions about growth, marketing spend, and profitability at scale.

2.4. EBITDA: The Final Step in the Waterfall

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) represents the final step in the Revenue to EBITDA Waterfall and is one of the most commonly used profitability metrics in business analysis. After determining CM2, we subtract payroll and fixed overheads, which typically include salaries, office rent, utilities, and other general administrative costs. This leaves us with EBITDA, providing a clearer picture of the operational profitability of a company.

EBITDA = CM2 - Payroll and Fixed Overheads

The Importance of EBITDA as a Profitability Metric

EBITDA is widely regarded as an indicator of a company’s financial performance, particularly its operational efficiency. It focuses on the earnings generated from core business operations before considering factors like interest on debt or tax obligations.

By stripping away these non-operational costs, EBITDA gives a true sense of how profitable a business is based on its day-to-day activities.

For growing companies, especially those in capital-intensive industries, EBITDA can serve as a valuable measure of profitability because it focuses on the core aspects of the business without being skewed by accounting practices or external factors like tax rates.

Linking Unit Economics to Overall Profitability

Understanding EBITDA is critical for scaling a business, as it reveals how well a company’s operational model can generate profit at scale. The connection between EBITDA and earlier metrics, like CM1 and CM2, is key to uncovering the overall health of a business. If CM1 and CM2 are both strong but EBITDA is weak, it indicates that fixed costs (e.g., payroll and overheads) are eating into profitability.

For example, a direct-to-consumer (D2C) brand might have strong CM1 and CM2, meaning that its production, service delivery, and marketing efforts are efficient. However, if payroll and fixed overhead costs are disproportionately high, this will significantly reduce EBITDA. This scenario suggests that while the unit economics of the product are sound, the company needs to reassess its administrative costs to scale profitably.

In addition to being a measure of profitability, EBITDA serves as a guide for whether a company is ready to scale.

If a business has strong CM1, CM2, and EBITDA figures, it indicates that it can cover its direct costs, marketing expenses, and operational overheads while still generating a profit. This strong financial footing means the company is primed for growth, ready to invest in scaling its operations, and confident that it can do so profitably.

On the other hand, weak EBITDA, despite strong CM1 and CM2, signals that fixed costs are too high to sustain growth without making adjustments. Businesses in this situation must focus on reducing overhead or streamlining operations to improve their EBITDA before considering any aggressive expansion plans.

In summary, EBITDA is the ultimate profitability metric in the Revenue to EBITDA Waterfall.

By connecting unit economics from CM1 and CM2 to the overall operational health of the company, EBITDA allows businesses to gauge their readiness for scale and identify areas that require attention to maintain profitability during growth.

3. The Flaws of a GAAP P&L: Why Traditional Accounting Misleads

Traditional accounting methods often group diverse costs under SG&A (Selling, General, and Administrative expenses), which can obscure important insights into a company’s scaling potential.

By aggregating costs like sales, marketing, and general overhead, businesses lose clarity on how much of their expenses are truly variable versus fixed. This makes it harder to pinpoint where cost savings or economies of scale could be achieved.

Here’s an example of a simple P&L Statement which lumps all costs into SG&A, missing the nuances of a company’s cost structure:

Table 1. Hypothetical company’s simple P&L Statement showing revenue to EBITDA waterfall for a year.

For example, under traditional SG&A accounting, businesses might fail to see that certain marketing costs scale with revenue (variable), while other overhead expenses remain constant regardless of growth (fixed). This lack of transparency can lead to decisions that harm rather than help profitability, as businesses might reduce variable costs that are actually driving growth or miss opportunities to optimize fixed overheads.

A more effective approach is to reallocate specific costs from SG&A and link them directly to Gross Margin, creating a sliding scale between fully variable costs (like COGS) and more fixed overheads.

This method allows businesses to track where economies of scale are being realized and where inefficiencies might still exist. Contribution Margin 1 (CM1) and Contribution Margin 2 (CM2) play an essential role in this reallocation process.

CM1 isolates service delivery costs—expenses that may not be included in traditional COGS but still scale with customer volume. CM2 goes a step further by subtracting marketing costs, revealing the true profitability per unit after accounting for customer acquisition.

These metrics help businesses differentiate between variable and fixed costs, providing a clearer understanding of where scalability is achievable.

By creating this sliding scale between COGS and overheads, CM1 and CM2 offer the granular insights needed to monitor scaling efficiency. As sales grow, businesses can see whether their per-unit costs are decreasing, indicating that they are successfully leveraging economies of scale.

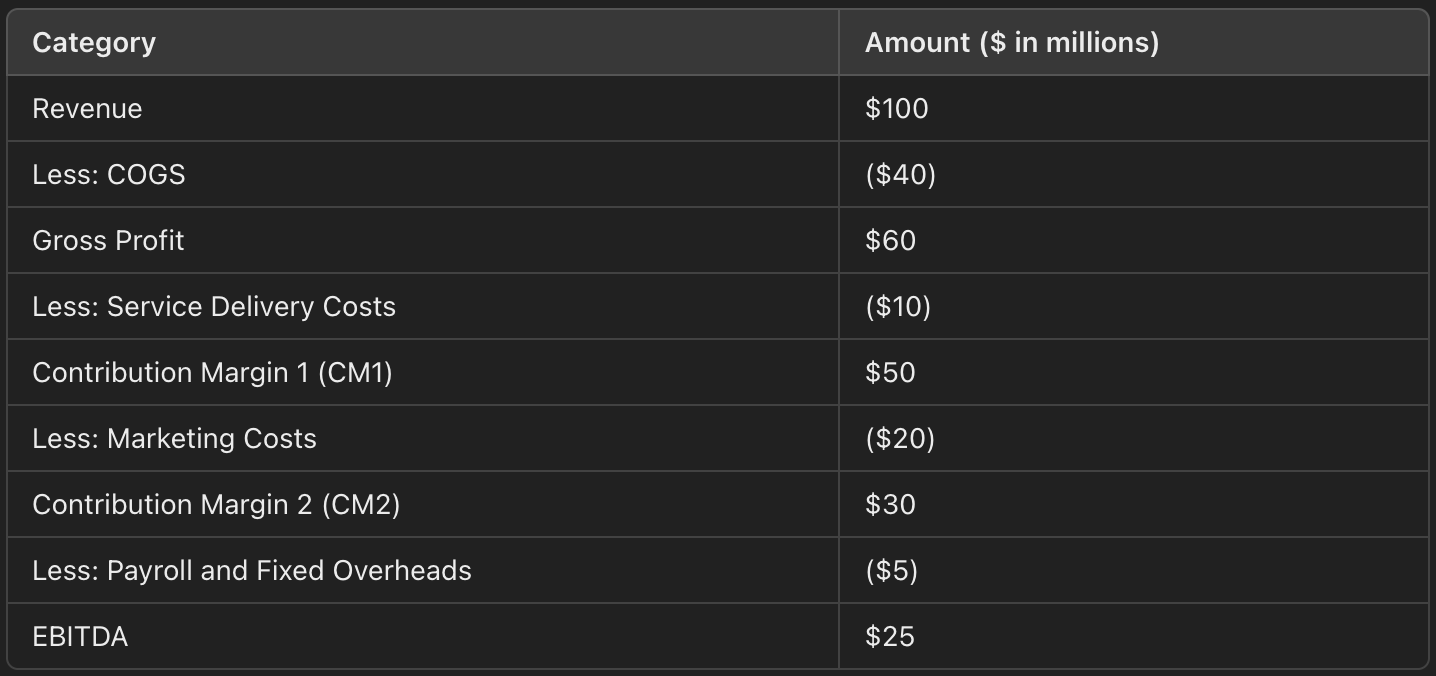

Here is a table of a more complex breakdown of the Revenue to EBITDA waterfall which doesn’t lump all costs in one category:

Table 2. Hypothetical company’s complex P&L Statement showing revenue to EBITDA waterfall for a year.

In contrast, traditional simple P&L statements obscures this dynamic, making it difficult to assess where growth opportunities lie.

Ultimately, reallocating costs from SG&A and analyzing them through CM1 and CM2 offers businesses the transparency they need to make smarter, data-driven decisions for scaling, preventing the costly missteps that often arise from relying solely on traditional accounting methods.

4. Practical Application: How to Use CM1 and CM2 to Drive Business Growth

In order to understand the importance of the waterfall framework, I will present a hypothetical example.

Direct-to-Consumer (D2C) companies sell products directly to consumers without relying on third-party retailers or intermediaries. This model gives companies more control over their pricing, branding, and customer relationships, while typically leveraging online platforms to reach customers. D2C models are common in industries such as apparel, consumer electronics, and personal care, offering a streamlined approach that often allows for higher margins.

Let’s consider a premium D2C watch brand that sells luxury timepieces directly to consumers through its e-commerce website. Each watch is priced at $300.

Step 1: CM1 (Direct Product Costs)

CM1 subtracts the direct costs of manufacturing, payment processing, and customer service from the sales revenue. This gives the company a clear view of how profitable each sale is before accounting for marketing or overhead.

Example: If the company spends $100 in manufacturing (materials, labor), $5 on payment processing fees, and $10 on customer service for each sale, CM1 for each watch would be $185 ($300 - $115). This metric helps the company understand its baseline profitability on every unit sold and whether its production costs are sustainable.

Step 2: CM2 (Adding Marketing Costs)

CM2 takes it further by subtracting marketing costs like social media ads, influencer partnerships, or paid search campaigns used to acquire customers.

Example: If the company spends $50 per watch in marketing, CM2 drops to $135 per unit sold ($185 - $50). This highlights how marketing directly impacts profitability and whether the acquisition costs are too high. If the marketing spend grows, it will quickly erode the company’s profits, so they may need to optimize their customer acquisition strategy or focus on organic growth to improve their margins.

Steps to Implement CM1 and CM2 Analysis:

Identify Direct Costs (COGS): Start by calculating all the direct costs involved in creating and delivering your product. This will form the basis for your CM1.

Factor in Marketing Costs: Subtract marketing costs like paid ads and promotions from CM1 to calculate CM2. This gives you insight into how customer acquisition impacts your bottom line.

Monitor and Optimize: Regularly analyze your CM1 and CM2 to uncover profit leaks, adjust pricing strategies, and reduce unnecessary expenses.

By using the waterfall approach of CM1 and CM2, D2C companies can make smarter, data-driven decisions to improve profitability. This granular view helps companies uncover profit leaks, identify hidden costs, cut unnecessary spending, and optimize their operations to scale effectively.

Whether it’s renegotiating supplier contracts or refining marketing strategies, focusing on CM1 and CM2 ensures that growth is not only achievable but sustainable.

5. Conclusion: The Power of Understanding Your Financial Metrics

Understanding financial metrics beyond traditional gross margin and SG&A (Selling, General, and Administrative expenses) is crucial for any business aiming to uncover hidden opportunities for growth. Gross margin can give you an initial sense of profitability, but it doesn’t provide the detailed insights necessary to make informed decisions about scaling your business. SG&A, on the other hand, bundles expenses in a way that often obscures the true drivers of profitability, making it difficult to spot where costs can be optimized.

This is where CM1 and CM2 come in. By breaking down your costs at each stage of the revenue-to-EBITDA waterfall, you gain a granular view of how direct service costs and marketing expenses impact your bottom line. These insights allow you to uncover hidden profit leaks, refine your pricing strategy, and optimize your cost structure to scale more effectively.

By adopting the CM1 and CM2 approach, you not only get a clearer picture of your unit economics but also gain the tools to drive sustainable growth in a competitive market. With this level of financial clarity, businesses can unlock new avenues for efficiency and profitability, ensuring they are set up for long-term success.