The Arbitrage Opportunity Framework: Everything is Arbitrage in the Big Picture

Summary: Arbitrage is the process of buying an asset cheaper than what you can sell it in another market, then selling it to make a profit. However, this logic isn’t just present in finance, but extends to the world around you at any point in time. There are always disparities in value, the key is spotting situations where a minimal effort leads to a significant reward. The arbitrage framework is like a new pair of eyes through which to view and conceptualize the world, where every possible decision becomes a contrast between the price you pay (in terms of money, effort, and time) and what you get (in terms of both material and immaterial value). You can reframe everything in life as an arbitrage opportunity, whether in the professional or personal realm. Doing so will allow you to live more intentionally, as you will make decisions justified in the certainty that what you are paying (or inputting) is lower than what you are getting.

Introduction

My aim in this article is to allow you to see the world through the lens of the arbitrage opportunity framework.

You will start noticing that everywhere around you, there are opportunities to capitalize on asymmetries in price: buy something for cheap and sell it for more instantly and effortlessly. This passive attitude towards the world will allow you to make more intentional decisions.

The world is a goldmine for these asymmetries in price. Mastering arbitrage involves being able to detect and exploit these, which will increase wealth, growth, and your sense of security and self-reliance.

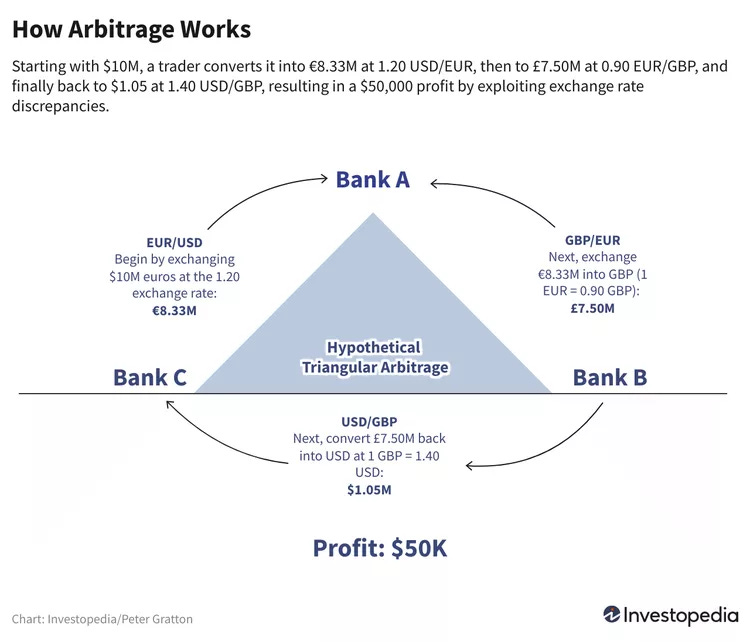

In business, arbitrage is the process of simultaneously buying and selling an asset to profit from a price difference. Assets are often cheaper on one market than others. Arbitrage is when you buy the asset in the cheap market and sell it in another market at a higher price. An effect of arbitrage is that it brings the prices of the same product available in various markets closer together.

Source: investopedia

Consider crypto arbitrage. Crypto arbitrage trading is a popular trading approach among experienced traders looking to exploit crypto price differences across different markets. Arbitrage traders aim to profit from the price differences by buying the cryptocurrency at a lower price in one market and simultaneously selling it at a higher price in another market.

Though this trading strategy started with traditional assets, it has become commonplace in the global crypto markets because cryptocurrencies are traded across several exchanges and countries worldwide. This makes cryptocurrencies potentially lucrative for arbitrage and allows traders to benefit from price discrepancies across these exchanges.

Imagine that BTC/USD is trading at $30,000/30,100 on Coinbase and at $30,200/$30,300 on Crypto.com. An arbitrage trader could quickly buy 1 BTC on the Coinbase exchange for $30,100 and simultaneously sell it on Crypto.com for $31,200, making a profit of $100.

This powerful concept is everywhere, when you compare the price of a basketball in Ebay versus Amazon, when you are doubting whether to get a haircut before traveling to India but realize you can get one much cheaper in India, or when you buy cheap cigarettes in a country before traveling to a country where cigarettes are much more expensive.

Not everyone takes advantage of arbitrage opportunities, but this may be because it is perceived as something exclusive to the business context.

In this article, I want to introduce you to the Arbitrage Opportunity Framework. This is the idea that everything is arbitrage in the big picture. The concept of arbitrage isn’t restricted to business. Everything can be reframed as an arbitrage opportunity.

This framework will help you detect all the instances of arbitrage around you which you can start leveraging and benefiting from immediately. You’ll note how its application in business is only a tiny fraction of its immense potential.

By implementing the Arbitrage Opportunity Framework, you will become a better decision maker, recognize different types of value, and benefit from the various untapped opportunities around you.

The Arbitrage Opportunity Framework

The Arbitrage Opportunity Framework invites you to look at life through a lens of potential gains, where everything, from decisions to actions, can be seen as an arbitrage opportunity.

A main characteristic of arbitrage is that with minimal effort and in an instantaneous way, you can profit from a price disparity around you. It’s about not wasting your own time/energy into creating profit, but instead leveraging on price disparities to do it for you. A good example is service outsourcing. Suppose you sell a logo design to a company for $1000 in England. Outsourcing the job to a freelancer in India and paying $100 for it would be a good way to, with minimal efforts, make a $900 profit.

The Arbitrage Opportunity Framework is a powerful outlook that reframes our choices, pushing us to find disparities in costs and returns that can be leveraged for our advantage.

A few examples can help clarify exactly what this framework is about:

Water at the Beach: People at the beach often find themselves far from convenience stores. This exhibits a dual arbitrage opportunity: for customers, the value of time saved by not having to leave the beach far outweighs the higher price of beachside water. For vendors, buying water in bulk at a lower price and selling it at a premium on the beach leverages the disparity between wholesale cost and the higher, convenience-driven price customers are willing to pay.

Product Dropshipping Alibaba & sell via Shopify: The dropshipping model is a prime example of arbitrage in the digital age. Entrepreneurs can list products from Alibaba on their Shopify stores without holding any inventory. When a customer makes a purchase, the product is shipped directly from the supplier to the customer. The seller's profit is the difference between the cost on Alibaba and the retail price on Shopify, capitalizing on the disparity between manufacturing costs in one country and the retail price willingness in another.

Value of Your Own Time as Freelancer vs. What People Will Pay: Freelancers often face the decision of how to price their services. If a freelancer can provide a service (e.g., graphic design) that takes them one hour to complete and clients are willing to pay significantly more than the freelancer's hourly rate, this disparity between the value of time and the payment received is an arbitrage opportunity.

Value of Your Own Time per Hour vs. Cost of Outsourcing Something: If your hourly earning potential exceeds the cost of outsourcing daily chores like laundry, cleaning and cooking, then doing so is an arbitrage on your time. Paying for these services frees you to focus on work that is more profitable, effectively "buying" time that can be invested in higher-earning activities.

Leasing Equipment in a Business vs. Buying It: This is an arbitrage on the cost of capital. For businesses, leasing equipment may be more cost-effective than purchasing it outright, especially if the equipment depreciates quickly or becomes obsolete. The decision hinges on comparing the cost of leasing (which may include tax benefits) against the capital and maintenance costs associated with ownership.

Renting an Apartment in a City vs. Buying It: The decision to rent or buy a home can be seen as an arbitrage decision based on the cost of capital and expected returns. If the cost of renting is lower than the cost of buying (when considering mortgage payments, maintenance, taxes, and potential property appreciation), then renting may be the better financial decision. Conversely, buying may be preferable if it offers a better return on investment through property value appreciation or rental income potential.

Source: Piyush Gupta via LinkedIn

Buying a Movie on Amazon Prime: This is a slightly different use of the arbitrage framework. The decision to purchase a movie will depend on the rewards of watching a film. You have to contrast the enjoyment of the movie with the price paid, and see if there is an asymmetric relation. You might note it’s a no brainer - the movie is fantastic and you are having a great time with friends, hence the cost is comparatively cheap.

Taking a Bus vs. Taking a Train: You might be traveling to Paris from London in the high season, when the Eurostar is costly. Arbitraging the cost of a bus versus the cost of a train will involve not just a price comparison but an overall experience comparison. Turns out the 2 hour train will likely be ‘cheaper’ when contrasted against the discomfort, danger, and bigger unreliability of an 8-hour bus.

Each of these examples shows how identifying and leveraging disparities in costs and returns across different contexts can lead to significant advantages, illustrating the broad applicability and potential of the Arbitrage Opportunity Framework beyond traditional financial markets.

The Arbitrage Opportunity Framework, in essence, is a tool for making wiser decisions. It's a mindset that encourages you to look for the disparities, the gaps in value, and make choices that leverage those gaps to create effortless gains. It's about learning to see the world as a series of potential arbitrage opportunities, helping you benefit from the many untapped opportunities for low-effort gains around you.

How To Spot Arbitrage Opportunities

In this section, I want to show you how to spot arbitrage opportunities around you in order to start taking advantage of price disparities today.

A good rule of thumb to spot arbitrage opportunities is when the value of your input is substantially less than what you get out of it. Remember arbitrage is about effortless and instantaneous profits.

However, it is not always evident where these opportunities exist. Thus, these are some common (and some less common) techniques to spot arbitrage opportunities:

1. Leverage Market Disparities and Service Cost Inefficiencies

Understanding and leveraging differences between markets or regions can uncover lucrative arbitrage opportunities. This principle applies not only to goods but also to services, where labor costs and demand can vary greatly.

For instance, a tech startup might discover that the cost of software development is significantly lower in Eastern Europe than in Silicon Valley. By outsourcing development work, the company can develop its product at a fraction of the cost while maintaining high quality. A real-world example includes companies like Basecamp, which hires talent globally, capitalizing on cost efficiencies without compromising on output quality.

Similarly, clean tech companies are exploiting geographical disparities in raw material costs. For example, firms are mining lithium in Argentina, where extraction costs are lower due to the country's vast lithium reserves and low tax, then selling it in markets with high demand for battery production, like the United States and China. This strategic positioning allows them to maximize profits by leveraging the cost differentials between extraction and selling points.

2. Leverage Time Value

The value of your time and others' time can create arbitrage opportunities. If you can complete a task (like graphic design work) in less time than your client expects, you're effectively creating value from the time disparity.

Conversely, if outsourcing a task frees your time to generate more income than the cost of outsourcing, that's arbitrage. For example, hiring a virtual assistant for administrative tasks can free up your time for higher-value consulting work.

The disparity between how much your time is worth and how much you can pay others for their time can create significant arbitrage opportunities.

A good example is the story of Tim Ferriss, author of "The 4-Hour Workweek."

"The 4-Hour Workweek" challenges conventional notions of work and productivity by offering strategies and mindset shifts to help individuals escape the 9-to-5 grind and create a lifestyle with more freedom and flexibility.

Ferriss used virtual assistants from lower-cost countries to manage day-to-day tasks, freeing his time to focus on high-value activities that significantly increased his income. This principle of outsourcing to leverage your time more effectively can be applied across various industries and personal endeavors.

3. Seasonal Variations

Seasonal arbitrage involves buying products off-season when they're cheaper and selling them during peak season when demand and prices soar. A classic example is buying and storing retail goods like Christmas decorations or winter coats during their off-peak seasons and selling them at a markup during peak demand.

Companies like Walmart and Costco excel in this strategy by securing off-season goods at lower prices and strategically stocking them to meet seasonal demand, thus enjoying higher profit margins.

4. Use Information Asymmetry

Information asymmetry arbitrage occurs when one party possesses more or better information than others in a transaction.

In the realm of real estate, companies like Zillow use vast amounts of data to identify undervalued properties that they can purchase and then sell at a higher market rate.

Similarly, in the clean tech sector, firms specializing in renewable energy closely monitor technological advancements and policy changes. An example is NextEra Energy, which invests in renewable energy projects in regions just before subsidies or regulatory changes make them more profitable, thereby capitalizing on their advanced knowledge to secure better returns on investment.

So, you can ask yourself: what unique knowledge or access to information do you have which could be valued very highly in the context you are in? Or what new context would immediately add value to your knowledge due to its higher inaccessibility?

—

In each of these techniques, the core principle of arbitrage—leveraging disparities for profit—remains the same. Whether through market differences, the value of time, seasonal fluctuations, or information asymmetry, individuals and companies that can identify and act on these opportunities often secure substantial advantages and success in their respective fields.

The “lighter option” often presents an opportunity for financial leverage.

I imagine the idea is clear. Like these, it’s possible there are many other techniques I might not be accounting for. I encourage you to find new tactics to spot arbitrage opportunities which can complement those above.

Remember, the ultimate goal is to increase your returns merely by being more observant, having more knowledge, and making smarter choices.

The Benefits of Arbitrage Opportunity

What are the benefits of implementing the Arbitrage Opportunity Framework?

The Arbitrage Opportunity Framework is all about being a passive witness of a world rich in disparities in value. Whether you are arbitraging between renting an apartment or buying it, outsourcing a task in order to free up space for yourself, or whether to buy your friend a drink, a focus on price asymmetry is always productive. It will allow you to see the value in making decisions and adopt a more intentional attitude towards them. For example, buying your friend a drink can be a great way to show comradery and care, which is far more valuable than the tenner you’d spend.

When applied consistently, the arbitrage framework offers tangible benefits that can significantly enhance both personal and professional dimensions of life. It offers a transformative approach to decision-making and resource allocation in both personal and professional contexts.

By identifying disparities in value, this framework allows individuals and businesses to optimize their actions for material or practical gains (i.e., maximum benefit with minimal waste), and personal or intangible gains (i.e., enhancing wellbeing and relationships).

Arbitrage encourages the efficient use of resources by identifying where they can be applied for the greatest return. For instance, a business might find it more cost-effective to outsource certain tasks to countries with lower labor costs, thereby freeing up resources to focus on core competencies and innovation.

By framing choices as arbitrage opportunities, individuals and businesses are encouraged to consider all variables, including time, cost, and potential return. This comprehensive analysis leads to more informed and strategic decisions. For example, an investor might choose to buy property in an undervalued market with the expectation that its value will increase, based on thorough research and analysis.

The framework pushes users to assess and prioritize what is truly valuable to them, leading to a more fulfilling allocation of time, energy, and finances.

This can manifest in personal choices, such as prioritizing family time over additional work hours by hiring help for household tasks, or in business, by investing in employee training to build a more skilled and motivated workforce.

Looking for arbitrage opportunities can drive innovation and growth. Businesses that identify underserved markets or new uses for existing products can capture significant value. A tech company, for example, might repurpose an existing technology for a new application, addressing a market need before competitors.

The framework also aids in risk management by encouraging the identification of lower-cost, high-reward opportunities. For instance, a company might test a new product in a small, controlled market before a wider release, minimizing potential losses while gathering valuable consumer feedback.

Individuals and businesses that effectively leverage arbitrage opportunities often gain a competitive edge. By capitalizing on inefficiencies in markets or processes before others, they can establish themselves as leaders and enjoy first-mover advantages. An example is a company that adopts renewable energy technologies to reduce operating costs and appeal to environmentally conscious consumers ahead of regulatory changes.

On a personal level, the Arbitrage Opportunity Framework encourages individuals to live more intentionally, aligning their actions with their values and goals for greater satisfaction. It promotes a mindset of looking for growth opportunities in every aspect of life, leading to personal development and a more fulfilling life journey.

In essence, the Arbitrage Opportunity Framework provides a powerful lens through which to view the world, uncovering hidden opportunities for efficiency, growth, and fulfillment. It's a strategy that, when applied judiciously, can transform how we allocate our most precious resources: time, energy, and capital.

The Arbitrage Opportunity Framework is more than just a tool—it's a mindset. Adopting this perspective can lead to a life filled with better choices, a deeper understanding of personal values, and a powerful drive for growth and improvement.

Conclusion

The Arbitrage Opportunity Framework applies to any situation where there is a possibility of gaining an advantage or profiting from differences or imbalances in your input versus your output. Every choice can be reframed as an arbitrage opportunity.

This means that in any large, n. By adopting this mindset, you will start passively looking for these opportunities. It is like adopting a new pair of eyes through which to navigate the world. When everything becomes a potential opportunity for arbitrage, you can make more intentional decisions that will boost your sources of positive returns.

The benefits of using the Arbitrage Opportunity Framework include increasing the quality of your decision-making, valuing what truly matters to you, and recognizing opportunities for growth. These will enhance your life exponentially, both professionally and personally.

Arbitrage isn’t just a concept for entrepreneurs, investors, and other individuals immersed in the finance realm. Arbitrage far transcends it. Indeed, everything is arbitrage in the big picture.